A Very Deep Dive into Tesla - Part 4 Tesla Valuation and Conclusion

Is Tesla the next most valuable company in the making? Or is Tesla the biggest bubble ever?

Valuation

I have opted for a relative valuation for my Tesla valuation because I have realized too many assumptions must be made within a DCF valuation for Tesla. Although a valuation based on multiple still involves many assumptions, the following valuation is my best attempt at valuing Tesla. This valuation will be broken down into 5 main parts: EVs, robotaxi, energy, insurance, and a summary at the end. Please take it with a grain of salt as it is not the most comprehensive valuation and remember that I am a bullish Tesla shareholder! Also, I encourage you to play with the numbers if you disagree with some of my assumptions and determine yourself what is more reasonable and realistic to you!

Please click this link for my valuation spreadsheet on Tesla!

EV Valuation

I have made several important. Firstly, in respect to growth, I have projected that Tesla will deliver 20 million cars in 2030. This target is what Elon has promised in Tesla’s earnings call. However, this target is by no means guaranteed or easily achievable. To provide some perspective, Toyota, and Volkswagen have combinedly sold around 20 million cars in 2019. If Tesla were to (only) reach Toyota’s statute in 2030, selling 10 million cars, their income from EVs will be cut by half, which will greatly impact their share price. Nevertheless, I believe that this goal is achievable by Tesla because they currently have the best electric vehicles on the market and the cost of owning a Tesla is declining rapidly. Tesla is still several years ahead of the competition. However, I would not be surprised if it took a couple more years for Tesla to achieve such goal.

Secondly, I have assumed that the average price of a Tesla will drop 5% annually. This is important as the average price of a Tesla will determine how many EVs they can sell, because there is only so many people that will buy an expensive car. The general public (especially in poorer countries) will want cars under 30k. Therefore, if Tesla can drop the average price quicker (via decrease in battery costs and production efficiency), they will be able to reach a wider market sooner.

Thirdly, gross margin is assumed to grow to 30% (2% annual growth) and operating margin to 25% (15% annual growth) in 2030. 30% gross margin should not be too big of an issue because Tesla’s gross margin is already at 25% in 2020. However, whether Tesla will achieve an operating margin of 25% still needs to be proven. The operating margin of Toyota in 2020 is only 8.2%. Nevertheless, since Tesla is producing their cars fundamentally differently than legacy OEMs, 25% should be achievable in my opinion. Furthermore, Tesla FSD subscription will also be a high margin business, thus making this target more realistic.

The result from this input is that Tesla’s electric vehicles business would be worth $2.6 trillion (4x current valuation) if you give it a 20 p/e multiple. If Tesla unfortunately only delivers 10 million vehicles, it would still be worth $1.3 trillion. I believe the outcome will likely be somewhere between these two cases.

Robotaxi Valuation

Robotaxi is the hardest part of Tesla to value. However, because the potential of robotaxi is so huge, it is necessary to value it in order to have a better picture at how much Tesla is really worth. The following are some key assumptions that I have made.

Firstly, the time when there will be Tesla robotaxi on the road is the biggest assumption. Many people believes that robotaxi are still years away and some Tesla bulls believes that its only one or two years away. Since no one knows when there will be robotaxi, my educated guess is that there will be robotaxi around 2024 (or one or two years later). This is because although the FSD beta technology have been improving exponentially, it may still require a year or two (or even more) to reach perfection. After a high level of safety is reached, regulators around the world must passed regulations permitting robotaxi. As a law student, I believe that the speed of new legislations and regulations will not be so fast that robotaxi will be possible within 2 years, therefore a robotaxi starting around 3-5 years would be more reasonable.

Secondly, the rate which Tesla charges robotaxi customers is also unknown. Currently, the average cost per mile for Uber is around $2-$3 dollars in the US. I believe that Tesla will likely offer a robotaxi price that undercuts Uber. Therefore, the assumption is that Tesla will start off with a price around $1.5 a mile to test the market out. However, as time goes on, Tesla will likely lower this price (hence the 20% annual decrease). The decrease in price is necessary because as more Tesla EVs join the robotaxi fleet, the market will eventually be saturated. As a result, Tesla will need to lower the price per mile to stimulate more demand. Furthermore, the average cost per mile for a ride hailing service is only around $0.5 dollars in China. The impact of such decrease in price will be huge because it can open new opportunities and new use cases for taxi. Previously a person may not take a taxi because of the expensive taxi fare, but eventually as the robotaxi fee decreases, a person may prefer taking a robotaxi in more scenarios than before. Furthermore, the average cost per mile of owning a car is between 35 cents to 65 cents in the US. This means that if Tesla eventually gets the robotaxi price under 35 cents, people will be economically better off taking a robotaxi everything rather than owning an average car, which will stimulate great demand.

Thirdly, the platform fee and operating margin will also impact how much Tesla can make on robotaxi. I have chosen 30% because that is what Apple made on its App store, a monopoly service. However, Tesla may choose any percentage as long as the percentage is not too high making it uneconomical for a Tesla owner to deploy his Tesla into the robotaxi network. I have assumed a 70% operating margin, the average operating margin of a software company, on the robotaxi network, because Tesla will mainly be providing software (like uber) and only provide additional services if they want to.

Fourthly, the number of Tesla fleet vehicles are based on Tesla’s EV sales growth mentioned earlier. Again, a 20 million delivery may not be met in 2030, which means that there will be less Tesla robotaxi on the road, hence lower income. Fifthly, the annual miles per robotaxi and occupied rate are also critical to the valuation, but there are no definitive numbers to them too. Generally, as the annual miles per robotaxi increases, the occupied rate should decrease because there are sometimes, for example noon and late night, where there is just not many people trying to travel.

The result from these inputs is that Tesla after tax income from robotaxi can reach a whooping 255.22 billion dollars. This applies with a conservative 20 P/E multiple will result in a market cap of over 5 trillion dollars. These numbers may sound ridiculous, but it does show the potential that robotaxi has and that if Tesla successfully delivers its robotaxi, it will be huge for Tesla’s share price.

Energy Valuation

Tesla energy is still relatively young and small compare to Tesla’s EV business. Furthermore, less historic information and reliable track records can be used. Therefore, the valuation is based on more assumptions compare to Tesla auto’s valuation. The following are some assumptions that I made.

Firstly, the growth of Tesla energy is assumed to be 40%. Tesla energy has grown more than 40% annually from 2016 to 2019, however has stagnated from 2019 to 2020. Therefore, there is no guarantee that a 40% long term growth rate will be achieved. I have chosen 40% growth rate to represent the potential that the Tesla energy has as a disruption to the traditional energy sector. Furthermore, Elon has claim that Tesla energy in the long run could be as large as the Tesla auto. Additionally, the revenue figures resulted from such growth rate is realistic, as the global solar energy market is expected to generate $300-400 billion in 2030, and Tesla by generating 57.68 billion in 2030, only represents 14-19% of total market share. This is achievable if Tesla maintains its competitive edge. Therefore, a high compound annual growth rate is chosen. However, this will growth rate can only be achieved if Tesla continues to decrease the costs of batteries and the prices of its solar energy products for their energy product to reach a wider market. A successful production ramp for their batteries and solar panels will also be critical.

Secondly, gross margin is assumed to be 25% and operation margin 20% in 2030. This gross margin is based on the average gross margin of solar energy business. Tesla should easily achieve this margin, or even likely to exceed it, as Tesla is known for its efficiency and ability to drive down costs. Operating margin is assumed to be 20%. However, it may be lower than 20% as it is unclear whether Tesla can achieve such level of efficiency (only 5% difference between its gross and operating margins) considering that the energy business may not yet mature in 2030.

Overall, it is much more unclear how Tesla energy is going to grow in comparison to Tesla autos. Therefore, I encourage you to use these figures as a reference or starting point and play with the numbers yourself to see what you reasonable perceive Tesla energy should be!

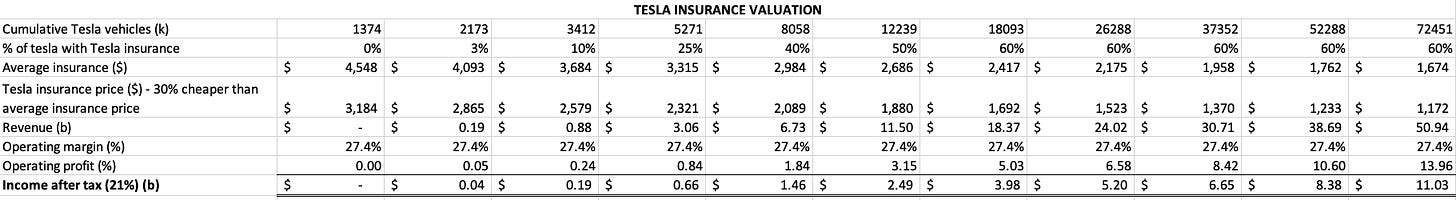

Tesla Insurance Valuation

Although Tesla insurance has just started off, it has tremendous potential, hence quite important to Tesla’s share price. There are several major assumptions for this valuation. Firstly, it is assumed that the Tesla insurance price will be 30% cheaper than the average insurance price for a Tesla because Tesla has the ability to better assess a person’s driving risks. Furthermore, a 30% difference is in line with the best price that Tesla currently offers. However, a 20% price reduction may also be reasonable.

Secondly, the average insurance cost for a Tesla is $4548 in 2020 in the US. It is assumed that by 2030, the average rate to insure a Tesla will equal to the rate to insure an average car, $1674, as the average price of a Tesla continue to decrease. One big limitation to this assumption is that the world’s average car insurance price is likely to be cheaper than the US price. Therefore, by using these numbers will likely overestimate the insurance premiums that Tesla may collected from Tesla owners in poorer countries.

Thirdly, the operating margin is assumed to be 27.4%, which is double the operating margin of progressive insurance’s operating margin at 13.7%. Since Tesla approaches car insurance in a fundamentally different way and Tesla is capital light, I believe that their operating margin will be significantly better than what the insurance field is currently earning. Ark Invest has estimated that the operating margin could be as high as 40%. Tesla will likely earn a higher operating margin than the current industry margin, however how much higher still needs to be seen.

Fourthly, it is assumed that 60% of Tesla cars will be insured with Tesla. It is likely that as Tesla insurance rolls out into more areas and countries, more Tesla owners will get insure with Tesla. Hence, the gradual increase in % of Tesla with Tesla insurance. I believe ultimately at least more than 50% of Tesla owner will be insured with Tesla, but whether it is 60% or even 80% or 90% cannot be determined at this stage.

Lastly, the amount of Tesla vehicles is based on the same assumption in Tesla EV valuation, and if Tesla failed to delivery that many vehicles, they will not be able to collect as much premium.

Ark Invest has brought up the idea that if Tesla successful rolls out robotaxi, Tesla insurance will likely be incorporated as a platform fee for the robotaxi. This is reasonable because if all Teslas are autonomously driving themselves, if any incident happens, the liability will consequently be on Tesla because there is no human driver to blame on. Elon himself has also confirmed this line of reasoning. Therefore, suggesting that Tesla will likely only earn insurance premiums if they do not have robotaxi.

Valuation – Summary

Combining Tesla EV, robotaxi, energy and insurance, we arrived at Tesla’s total valuation. There are two main situations that must be considered: (1) Tesla with robotaxi and (2) Tesla without robotaxi. I encourage you to download the excel spreadsheet, play with the numbers, alter any assumptions or figures that you believe is unreasonable and insert the P/E multiple that you think is appropriate to get your own reasonable estimated share price for Tesla!

In the first situation, Tesla’s estimated share price will be significantly higher, signaling the massive potential that robotaxi can unlock. I have assumed a 2% annual dilution to Tesla’s total outstanding shares. However, the reality may be bigger or smaller depending on how Tesla finances and whether Elon are vested with more stock options. The result from all the combined input (Tesla EV + robotaxi + energy + other revenues) is that if we give Tesla a 30 P/E multiple, its share price will reach around 9000 dollars at the end of 2030. This implies a market cap of 11 trillion dollars. Please remember that this is a very bull case for Tesla and many things must go right (especially robotaxi) for this market cap to be achievable by Tesla. Although 11 trillion dollars do seem fairly obscure, considering Apple’s market cap is only $227 billion in 2010, and it is currently worth $2.17 trillion, 11 trillion may not actually be so unreasonable (but anyways, I know, even I think 11 trillion seems a bit unbelievable :)).

In the second situation. Tesla’s estimated price will be significantly lower (and more ‘reasonable :)) I have used the same assumption for total shares outstanding. The result from the combined input (EV + energy + insurance + other revenues) with a 30 P/E multiple implies that Tesla’s shares will be worth around $3500 and have a market cap of 4.5 trillion dollars. Although robotaxi is not included within this valuation, this is still a relatively bullish valuation. Realistically, for Tesla to achieve this share price and market cap, they will need to execute very well for the next few years on their EV, energy, and insurance business.

In reality, either of these scenarios will likely not play out exactly in the way that I have estimated it. Nevertheless, as a Tesla shareholder, and after extensive research, I do believe that Tesla still have massive potential to grow and can at least 5-10x its share price if Tesla continue to execute well and maintain their competitive edge to deliver stellar growths.

Conclusion

Tesla, what a fascinating and excited company. I must admit after extensive research, I am more bullish than ever on Tesla. Tesla have so much potential in the EV, robotaxi, energy and insurance market. It feels like a lot of it is for Tesla to lose rather than for Tesla to win. Although there are certainly many unknowns as to whether Tesla can realize all its potentials, Tesla sure have some serious competitive advantages that can propel them to such ambitious. Allow me to recap all the competitive advantages that Tesla have.

Tesla have the best engineers’ talents in the world as Tesla is the most attractive company for engineering graduates. Tesla have the best manufacturing process in the auto and energy industries thanks to Elon’s cost savings and efficiency first mindset. Tesla is not only enjoying but also consolidating their first mover advantage in EV and large-scale autonomous driving solution. Tesla is making it harder for its competitors to catch up. Tesla is fully vertically integrated with almost everything fully designed and manufactured in house. Apple has already shown us how much benefits a vertically integrated structure can provide. Tesla have Elon Musk, the most ambitious and hardworking CEO on the planet albeit being controversial at times. Tesla is the only company that seeks to provide a comprehensive green energy solution from energy generation, storage and EVs. Tesla have one of the best brands following in the world. Tesla is software focused and seeks to provide the best hardware and software solution. Last but most importantly, Tesla arguably have the best products in all the categories that they have entered. All these competitive advantages can help Tesla to achieve what Elon hopes to achieve.

On the flip side, let me also recap you with all the risks that are associated with Tesla. Tesla like all other cars and batteries manufacturers, faces battery supply constrain. If this constrain is not addressed properly or even worsen overtime, it will significantly limit Tesla’s future growth opportunity. Although competition is still not at Tesla’s level, there is no doubt that competition is heating up. Tesla will need to continue to execute well to maintain their competitive edges. Tesla’s service and quality control issues may be a ticking bomb if Tesla got mold into a bad impression of being ‘unreliable’. This may greatly negatively impact Tesla’s future sales figures and damage Tesla’s brand. Tesla faces many fake news attack and media oppression, particularly in respect to Tesla’s FSD, which may further add to public’s impression of Tesla being unreliable and increase public misunderstanding. Tesla’s relationship with the Chinese government in the long run may not be as great as now. Tesla still need to build several factories and ramp up production for them to reach their ambitious goals. On its way, Tesla may hit roadblocks while ramping production. Lastly and most importantly, Tesla must continue to have the best product on the market.

After all the extensive research, I personally believe that Tesla will overcome most of these risks because their competitive edges separate them by a considerable margin from their competitors. As a Tesla shareholder, I am very keen to see how the future for Tesla plays out, and hopefully, we can witness the Tesla growing into the next most valuable company in the world.

Thank you very much for your time and I hope you have enjoyed my very deep dive on Tesla. If you like this type of in-depth analysis on exciting companies, please subscribe to my newsletter for more future updates. Also, please share this with anyone that you think are interested in Tesla and drop a comment below!